The concept of downside risk is often easy to overlook during periods of strong stock market performance. In 2023 and 2024, the S&P 500 generated total returns more than 25% each year. Such results can lead some investors to believe that a bull market can continue indefinitely. While nobody can say for certain what direction stocks will move in 2025, investors should recognize that downside risk always exists. Markets can, at times, change quickly, and what was once a favorable environment can suddenly become more challenging.

According to Rob Haworth, senior investment strategy director with U.S. Bank Asset Management, short-term patterns are difficult to detect. “It doesn’t necessarily follow that after two strong years, risks to investors are any higher.” Yet Haworth points out there are issues for investors to consider.

“Market valuations are considered rich at current price levels, so if issues do arise, it puts investors in a potentially more exposed position,” says Haworth. “In addition, much of the market’s 2023 and 2024 gains were driven by a narrow group of technology-oriented stocks. We would like to see the wealth spread to a broader group of stocks.” Haworth notes that unlike what happened in 2023, in 2024 some other sectors were competitive with technology stocks. Ideally, 2025 will bring even more sector performance balance, notes Haworth.

What is downside risk?

Downside risk is the potential for your investments to lose value in the short term.

History shows that stock and bond markets generate positive results over time, but certain events can cause markets or specific investments you hold to drop in value. Owning a diversified mix of assets can provide downside risk protection, helping you avoid significant portfolio losses, aiding your path to achieving long-term financial goals.

It’s important to note that you should consider your downside risk strategy even in a stable market environment. That way, you’ll be prepared when a downside risk event occurs.

What is a downside risk event?

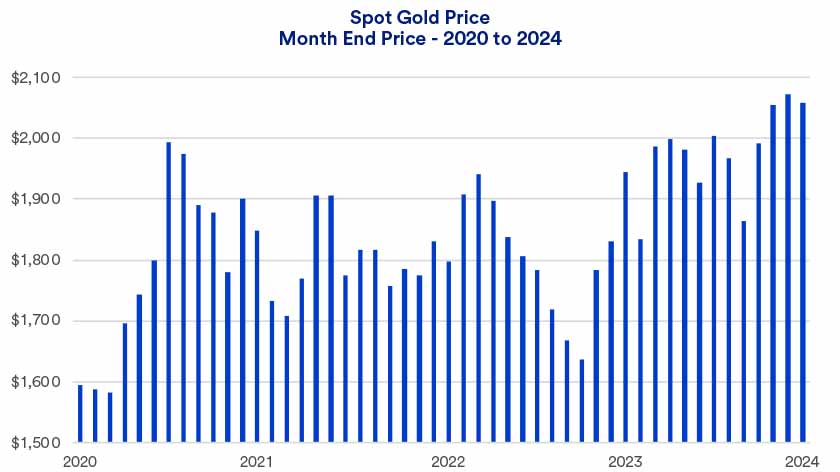

It’s normal for markets to experience short-term price swings due to specific events that affect investment performance. This occurred when the COVID-19 pandemic hit in early 2020. As schools, workplaces and stores closed, the U.S. stock market, as measured by the S&P 500 Index, lost 19.6% in the first three months of 2020. Some investors reacted to these losses by repositioning their assets out of equities, but this ultimately detracted from their long-term investment strategies, multiplying the impact of the downside risk. Those investors missed out on the rapid recovery. The S&P 500 ended 2020, with an 18% gain.