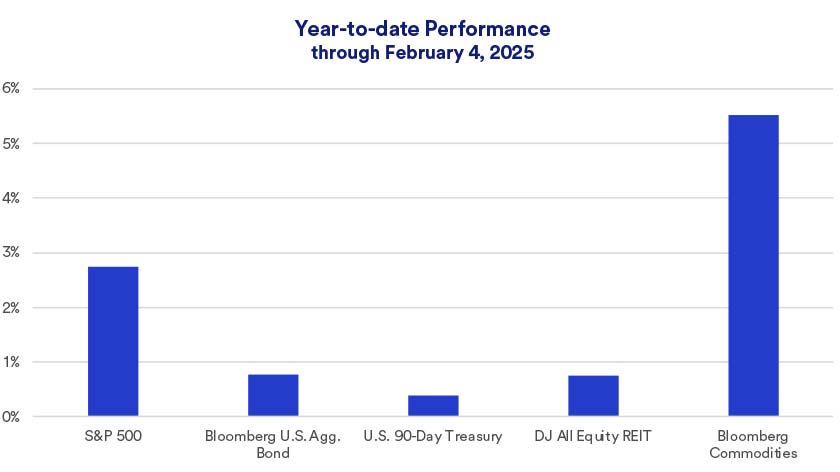

“In 2023 and 2024, the equity story was all about technology stocks,” says Haworth. Yet in January 2025, information technology was the only S&P 500 sector in negative territory.1 “Technology spending remains significant, however, which should support information technology stocks going forward,” he notes.

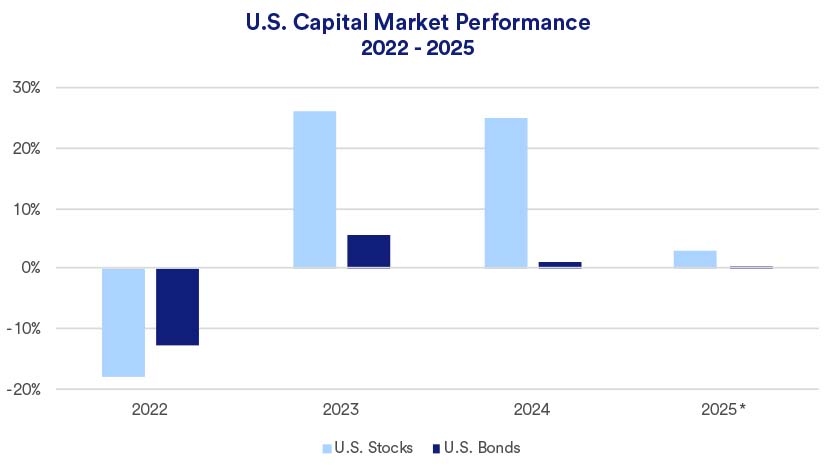

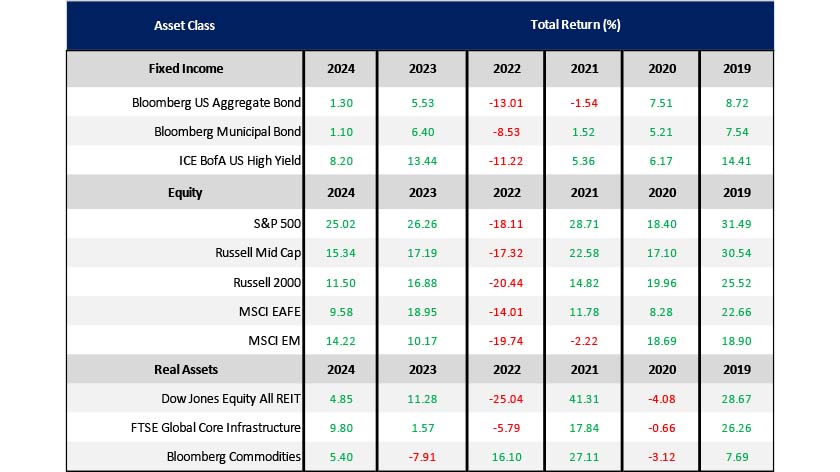

The fixed income market is off to a slower start. In early 2025, the benchmark 10-year Treasury yield approached 5%,2 tempering bond returns (bonds lose value as interest rates rise). By January’s end, bonds, as measured by the Bloomberg Aggregate Bond Index, achieved a modest total return (0.53%).3

Tactical investment opportunities in today’s market

In today’s environment, investors may wish to consider a less than neutral weighting in fixed income, with a greater emphasis on equities and a neutral allocation to real assets. Beyond that broad allocation strategy, Haworth says there are some tactical opportunities to explore.

Opportunities for tactical asset allocation in today’s environment

- Global equities: Equities in general appear to be well positioned given expectations for continued economic growth. “Some of that equity overweight should be directed to global stocks,” says Haworth. “In early 2025, non-U.S. stocks offer more attractive valuations than their U.S. counterparts.”

- Complex credits: Structured credits offer a yield advantage. “Given the positive economic story we currently see, it’s a worthwhile time to try to capture extra yield from more complex credits. Non-taxable fixed-income investors may want to consider residential mortgage-backed securities (MBS) not backed by the government, which have strong fundamentals and offer competitive current income. Commercial mortgage-backed securities and collateralized loan obligations are also well positioned, according to Haworth.

- Municipal bonds: Tax-aware investors can earn extra potential returns by slightly extending maturity profiles in municipal bond holdings and incorporating a modest allocation to high-yield municipal bonds. Haworth notes that while adding risk, “high yield municipal bonds tend to have lower default rates than we see in the corporate high-yield market.”

- Insurance-linked securities: Tied to the sale of reinsurance products, these securities can offer highly competitive income streams in the current environment for certain types of investors, particularly within trust portfolios.

Dollar-cost averaging

The second situational strategy is dollar-cost averaging. As you accumulate cash in your portfolio, investing those dollars into asset classes with higher returns, such as equities, is key to meeting your long-term financial goals. During volatile times, dollar-cost averaging may increase your equity investing comfort level. This strategy involves investing a portion of your cash balance into the target equity portfolio at regular intervals (such as over a 6 to 12-month period), rather than investing in a lump sum.

“With the U.S. equity market near all-time highs, investors may experience regret if they invest just before the market pulls back.” Haworth says dollar-cost averaging smooths out “not just the market’s bumps, but potential feelings of regret.”

Portfolio rebalancing

The third situational strategy addresses times when asset prices move in different directions and at different speeds. These return variations can cause your initial portfolio allocations to drift from your long-term strategy. Rebalancing your portfolio from time to time may help you achieve your investment objectives.

“There’s been a big, stock-bond performance gap and a disconnect between domestic equities and international equities,” says Haworth. “This may create an opportunity for investors to shift some assets to help better balance a portfolio consistent with one’s goals.”