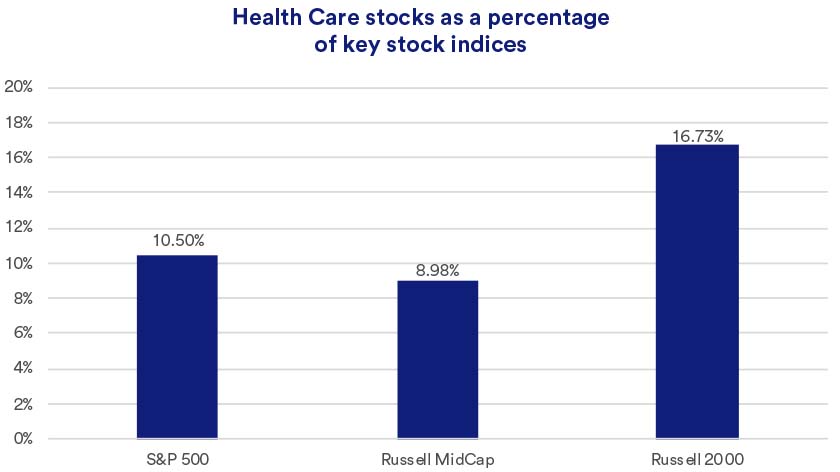

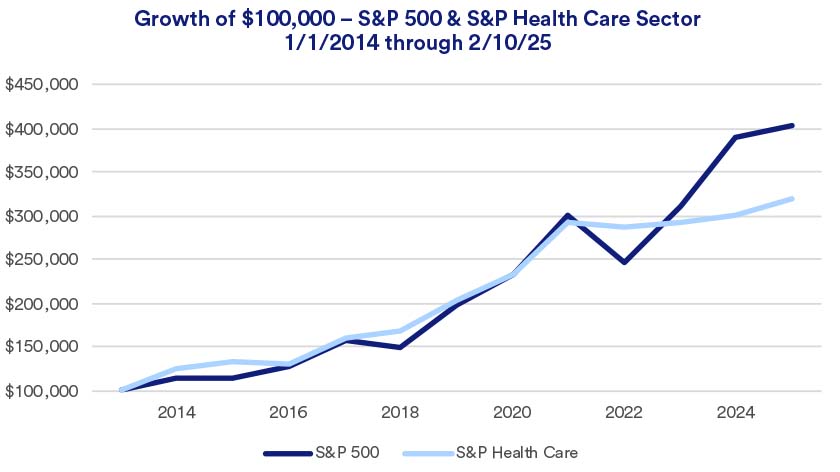

“Investors can gain exposure to the healthcare sector by owning the S&P 500 through a passively managed index fund or ETF,” says Haworth. “Investors may also want to take a more selective approach, as the record demonstrates there can be varied performance within the healthcare sector.”

Healthcare investing

In early 2025, investors are taking a wait-and-see approach regarding potential new Trump administration policies. Under nominated Health and Human Services Secretary Robert F. Kennedy, Jr., major companies in the industry could face greater scrutiny and need to adapt to different policy approaches than was the case previously. “The concerns surrounding Kennedy’s nomination seemed to play out more as 2024 wound down,” says Haworth, “but no specific policy changes are yet on the table that may impact larger healthcare companies.”

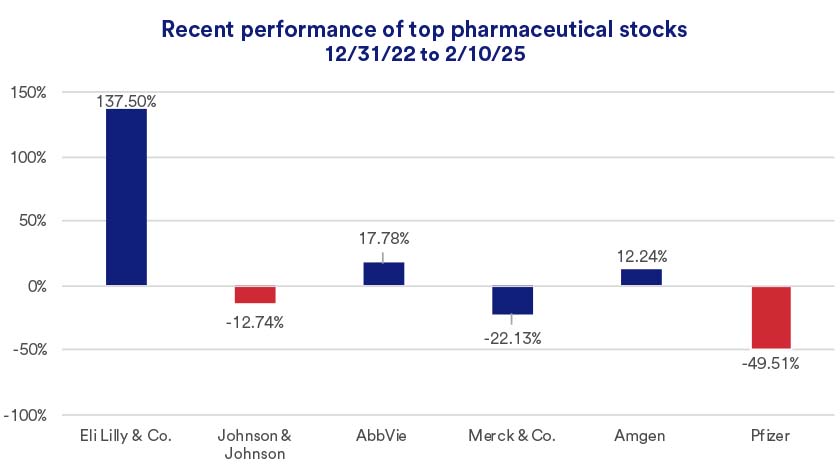

Additionally, the disparate fortunes of healthcare sector participants, which can change significantly over time, create some challenges for investors. “There are clear opportunities in more active management of healthcare investments given the push-pull dynamic of demand relative to the winners-and-losers system in the pharmaceuticals field,” says Haworth. “For others, relying on a passive management approach, an S&P 500 Index fund or ETF, may be the best way to access the investment potential of the healthcare sector.”

As you explore such investment opportunities, be sure to discuss it with your financial professional. You’ll want to consider how healthcare investments can work within the context of your overall financial plan and investment strategy.