Home sales up at the end of 2024

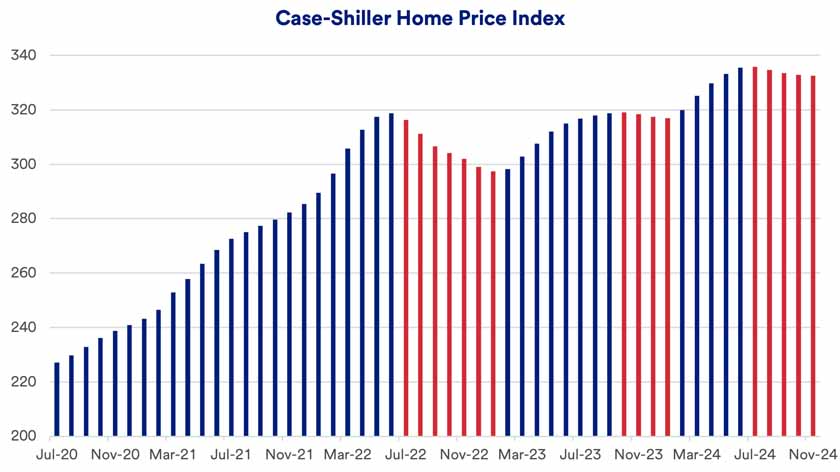

December’s existing home sales jumped 2.2% from the prior month, marking the third consecutive monthly uptick. It represented the strongest month for existing home sales since February 2024.2 “It’s encouraging news,” says Rob Haworth, senior investment strategy director with U.S. Bank Asset Management. “From a historical perspective, however, housing activity remains low, but the latest data indicate that the market isn’t deteriorating.” Notably, on an annual basis, existing home sales in 2024 fell to the lowest level in nearly 30 years.2

Lagging existing home inventory remains a concern. “Higher rates are making people in homes financed with low mortgage rates reticent to move,” says Haworth. “The challenge is we ultimately need more homes.”

December new home sales also trended higher. According to estimates of December activity, new home sales rose 3.6% from November and were 6.7% higher than a year earlier.3 But Haworth notes that homebuilder sentiment, a possible indicator of when supply might expand, remains relatively neutral.

One problem, according to Haworth, are market uncertainties as new Trump administration policies emerge. “There’s a lot we don’t know about how, in the next 3-6 months, various policies might impact the labor market, interest rates and building supplies,” says Haworth. For example, possible immigration crackdowns may reduce the construction labor force. Tariff policies could impact building supply costs. Interest rates could potentially adjust higher if inflation again becomes a major issue. “Additional supply pressures will result from the significant rebuilding required in the Los Angeles area following the damaging fires in that region,” says Haworth.

Despite recent improved activity, “the housing market is pretty much range-bound in the present environment,” says Haworth.

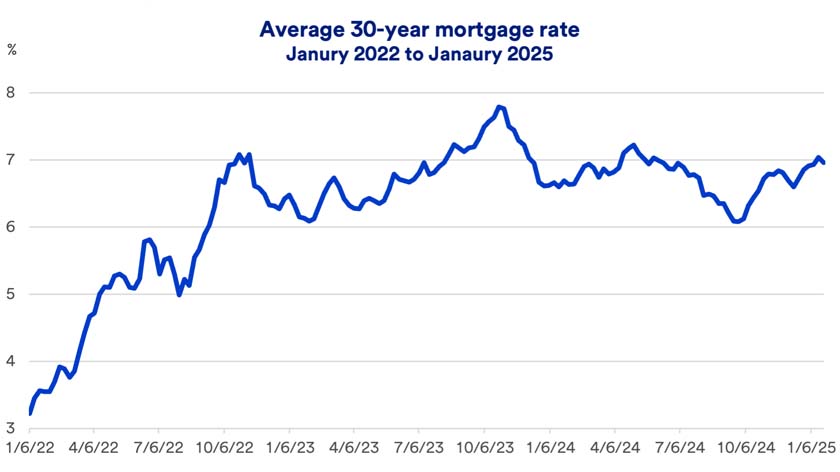

Why are mortgage rates rising?

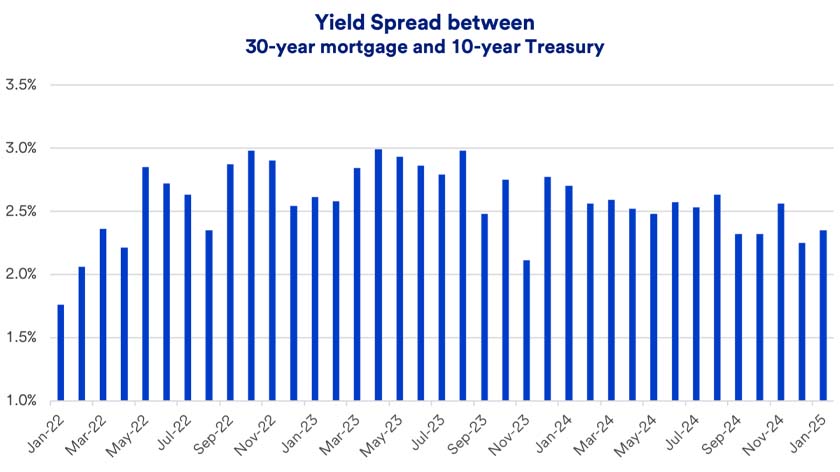

“Today’s mortgage rates reflect higher yields in the bond market, but also a relatively wide premium spread between 10-year U.S. Treasury notes and mortgage rates,”4 says Haworth. “Part of that is due to the Federal Reserve (Fed) continuing to trim its holdings of mortgage-backed securities.” Haworth says that reduces market liquidity. “Major tightening in the 30-year mortgage to 10-year Treasury spread will likely require a change to the Fed’s current policy of reducing its mortgage-backed securities holdings.” In January 2025, the spread between 30-year mortgages and 10-year Treasuries widened modestly but remains well below recent peaks.